Streamline your insurance company

Digital signing and forms enhance efficiency and customer satisfaction in insurance companies. Complete contracts and claims in minutes, reducing turnaround times. Simplify data collection, cut errors, and lower administrative costs.

Ensure security with tamper-proof, legally binding documents. Support sustainability by reducing your carbon footprint. Embrace digital solutions for efficient, secure, and eco-friendly operations.

Increased efficiency

Speed up the processing of contracts and claims, reducing turnaround times from days to minutes.

Cost savings

Lower administrative costs by eliminating the need for paper, printing, and physical storage.

Enhanced security

Ensure documents are tamper-proof and legally binding, protecting sensitive client information.

Improved accuracy

Minimize errors with automated data entry and validation, ensuring accurate and consistent information.

Convenience

Clients can sign documents from anywhere, at any time, using any device, enhancing the user experience.

Environmental benefits

Reduce the company’s carbon footprint by going paperless, supporting eco-friendly business practices.

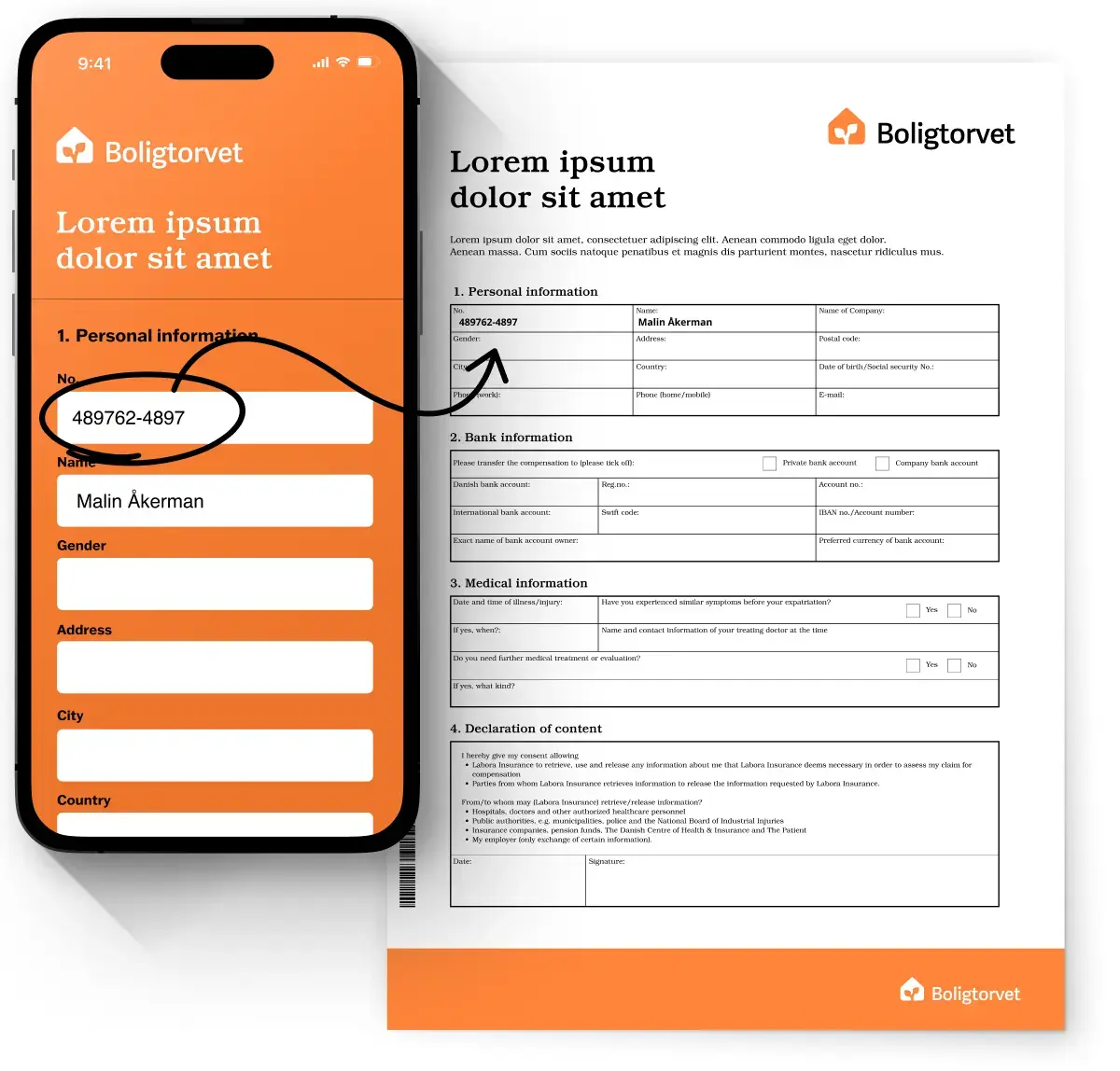

Benefits of using digital forms

Digital forms speed up processing, cut costs, and enhance accuracy with automated data entry. They ensure security with encryption, and clients can complete forms anytime, anywhere. Going paperless also supports sustainability. Overall, they streamline operations and boost satisfaction.

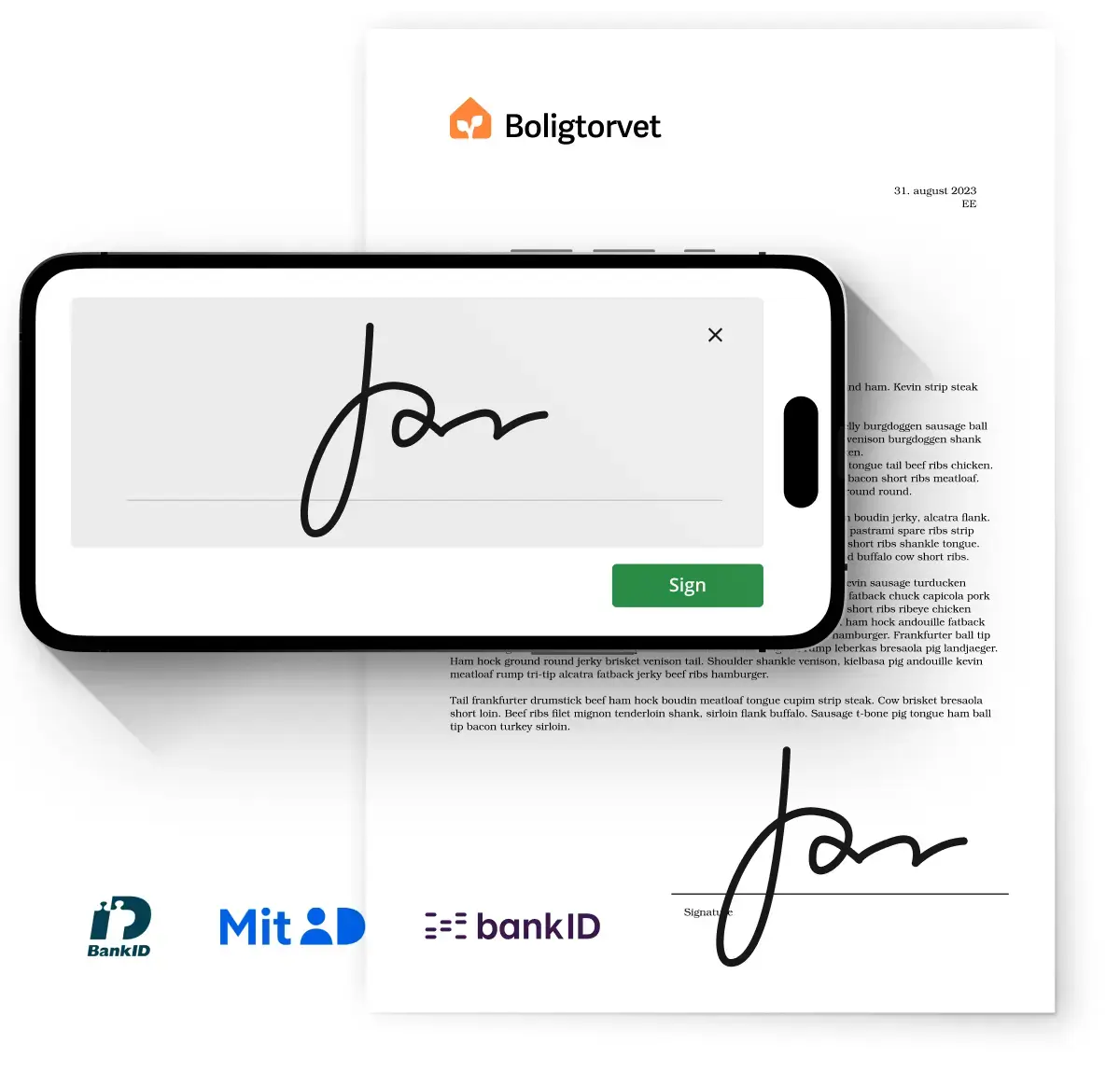

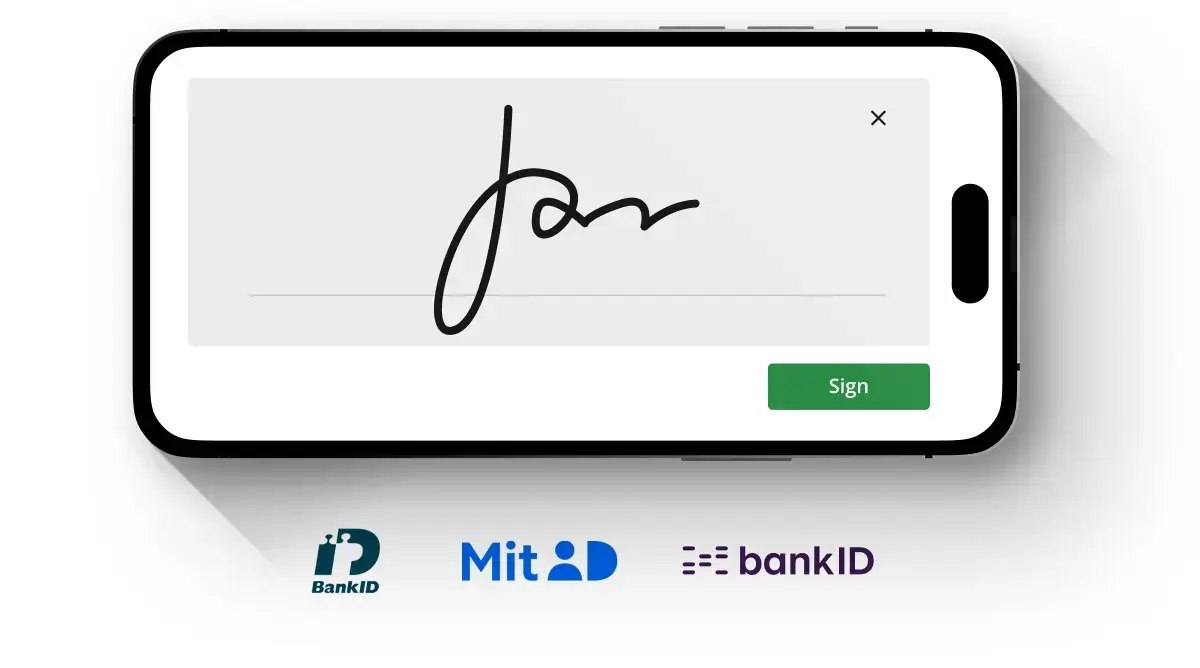

Authentication and signing with trusted standards

Addo Sign is designed to handle various security levels. Use either screen signatures or recognized European eID standards, which provide the highest security against signature forgery.

How digital signing has transformed insurance and pension companies

Digital signing has streamlined processes, reduced costs, and enhanced security for insurance and pension companies. Contracts and claims are finalized quickly, improving efficiency and client satisfaction. Going paperless cuts administrative expenses and supports sustainability.

Clients enjoy the convenience of signing documents anytime, anywhere, making operations more efficient, secure, and eco-friendly. This transformation positions companies for greater success in the digital age.

Implementing digital signing in insurance and pension companies

Implementing digital signing in insurance and pension companies streamlines operations and enhances security. This technology accelerates contract and claim processes, reduces administrative costs by going paperless, and ensures documents are tamper-proof and legally binding. Clients benefit from the convenience of signing documents anytime, anywhere, improving overall satisfaction. Adopting digital signing positions companies for greater efficiency and success in the digital age.

Ready to get started?

Find out how Addo Sign can help your organisation.